4.1 FDR - Founding team

relates-to:: 07-Projects/TTSU/Articles/The Periodic Table of Tech Start-Ups/README

This document precedes HRE - Hiring Policy Board Composition and succeeds

Who should be considered a founder?

Being a founder is as much a privilege as it is a duty. It's a privilege as the founder status will stick to your name for the whole existence of the company. And assuming the company does well, soon enough your name is topped with an aureole... People will look up to you as your behaviour, work ethic, work habit... will be deeply entrenched in the company culture. As a founder, or a member of the founding team, you get to set the culture of the company. A founding team that is not aligned, that struggles to set the company in motion or worse, that openly disagrees is likely to reproduce a company culture of opened arguments, insane politics and the likes. Conversely, a founding team that promotes transparency, constructive debates and leadership is more likely to develop a company culture with strong team bonds, collaborative attitude and a stronger team spirit.

Some founders' privileges:

- Leadership: Founders typically have the final say in decision-making, and direct the company’s vision and strategy. They are the ones to pitch to early investors.

- Equity: Founders often receive a significant portion of the company’s equity, allowing them to benefit financially as the company grows. They have access to equity at nominal value.

- Creative Control: Founders are able to make decisions and take actions that shape the future of their business. They set the culture of the company.

Some founders' responsibilities: - Fundraising: Founders are responsible for securing capital from investors and other sources to fund their operations.

- Visionary Thinking: Founders are responsible to develop a compelling vision for the company’s future.

- Networking: Founders should develop and nurture relationships with potential partners, customers, investors, and other stakeholders in order to grow the business.

Should be considered founders are all contributors (individual or entities) who participate in the inception of the company and who will play a significant role in the development of the company. The latter point is critical as you want to avoid as much as possible to have future sleeping share holders, individuals or entities who do not contribute any longer and who could potentially arm the growth of the company as shareholder get to vote the resolutions during share holder meetings.

Guidelines for who should be considered a founder: - Contributed Meaningful Resources or Effort: A founder should have invested time, energy or money into the startup’s foundation or growth in a meaningful way that has contributed significantly to its success so far. This is often referred as "Sweat equity"

- Had Significant Influence on Company Decisions: A founder should have had a significant impact on major decisions regarding the startup's mission, strategy, structure, or culture in its early stages of development.

- Played an Active Role in Building The Company's Early Team Structure & Culture: A founder should have played an active role in building the team structure and culture of the startup during its early stages of development through recruitment, onboarding processes, etc.."

About share ownership

- There is no right or wrong for share ownership as you incorporate. however, there are few guidelines you want to follow:

- Equi-repartition is usually a bad idea: although this may sound like a good idea at first, and certainly a way to avoid difficult debates, an equal split of equity is usually not recommended. It is unlikely that the role of CEO will be split with an equal share of responsibility. Same goes for other critical roles, such as CTO role in a technology company. Equity should be split to represent the future role and responsibilities of each member of the founding team. In addition, a fully balanced equity split may lead to statu quo or even a deadlock.

- The cap table reflects a story and does not necessarily recognise past contribution: Instead, equity ownership should reflect what is expected from each contributor as the company grows.

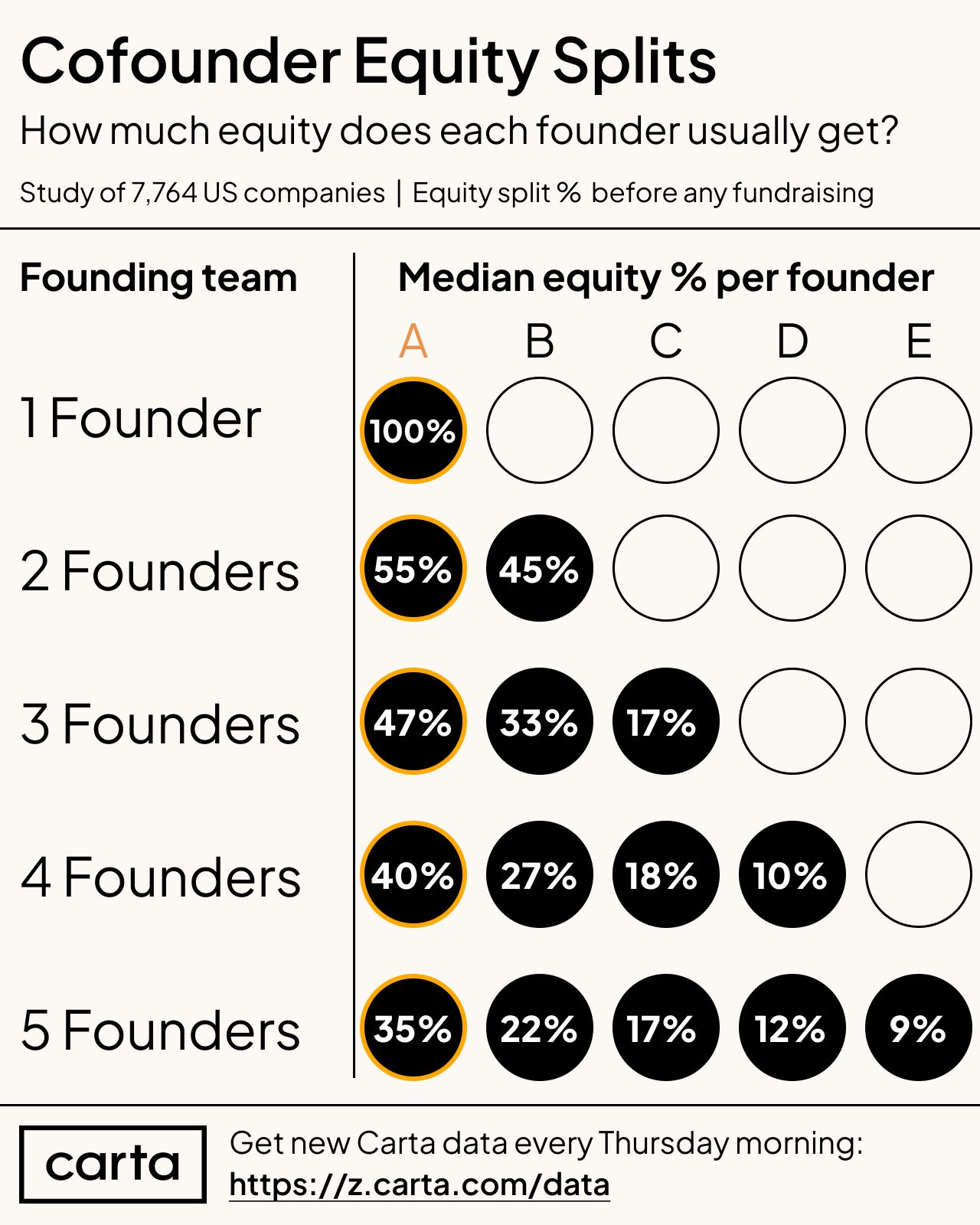

- Below is a survey of equity split among founders, performed on over 7,000 US companies

- As the company grows and as investors step in, shareholders will most certainly experience dilution based on the amount of capital raised, company valuation, option pool dimension... The basic principles of a capital increase is as follows:

- An incoming shareholder will run a pre-money valuation of the company. This represents the value the incoming shareholder is willing to pay to get shares in your company. For instance 100.

- Both parties agree to inject capital in the company to get it running. For instance 50.

- The post-money valuation will equal to the pre-money valuation plus the amount of capital injected, 150 in this case.

- Se you owned 55% of the company prior to the investment. Your value represent 55 out of the 150 total, so your updated share ownership now represents 55/150 = 36,7%.

- The incoming shareholder owns 50/150 = 33%

- Typically, both parties will agree on a stock-option pool for instance 10%. As the stock-options get vested and are being exercised, all historical shareholders will experience another 10% of dilution (the size of the option pool, assuming all are fully vested and all are exercised).

- In this example, your final ownership (assuming you did not get any of the stock-options) will be 55/160 = 34,4%

- Below is a survey representing the evolution of share ownership performed on over 1,000 US companies